Cryptocurrency exchange Coinbase reported that its revenue had declined by 61% in the latest quarter as crypto prices dropped and trading volumes dropped.

The San Francisco-founded company on Tuesday reported an after-tax loss of $1.1bn, compared with the $1.6bn net profit it registered in the middle of the crypto boom a year ago.

The $446 million loss boiled down to a partial charge on cryptocurrency and venture capital investments.

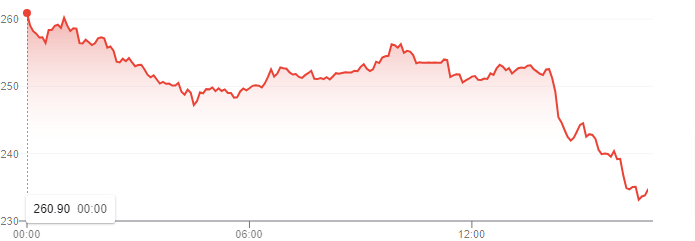

Crypto Winter

Coinbase stock plummeted 5% in after-hours trading, having lost roughly 11% during the day. The collapse in bitcoin and other crypto prices sent the company into the red in the first quarter, leading it to lay off 18% of its staff in June.

With the trading volume down another 30% compared with a weak first quarter, it suffered a $647m operating loss before the impairment charge and its net cash position fell by about $400m, to $2.8bn.

In an attempt to ease Wall Street’s concerns about its financial condition in the middle of what it called a crypto “winter”, Coinbase published information concerning the amount of money it had spent and had allegedly not experienced any monetary losses despite the financial difficulties hitting it.

Coinbase predicted that it would maintain that same ratio this quarter, but then drop down accordingly in the next year.

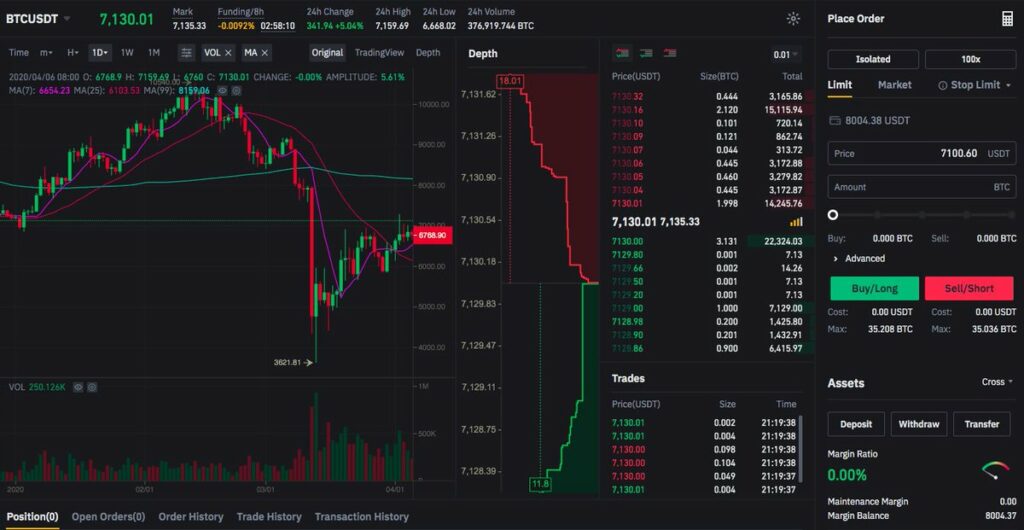

Volatility Rocks

A spokesperson said the company understood investor concerns about stock-based pay and was “aligned” with shareholders on the issue. But she also said Coinbase took a longer-term view of the costs due to the volatility of crypto markets.

Wall Street had been expecting a loss of $2.65 a share on revenue of $832m. Shares have been volatile in recent days, jumping more than 30% last week on an alliance with BlackRock.

SEC investigation into Coinbase has stirred mixed feelings in the air with varying winter opinions. Will laying off more staff be a better solution or cause more damage as the workforce drops?